Understanding Liabilities

Appropriate handling of the tradelines and debts in the Liabilities section is required so that your lender receives a file with the correct TDS and an understanding of what debts are remaining, being paid, etc.

Related Training

Issues with Credit Liabilities

Understanding the Liabilities Section

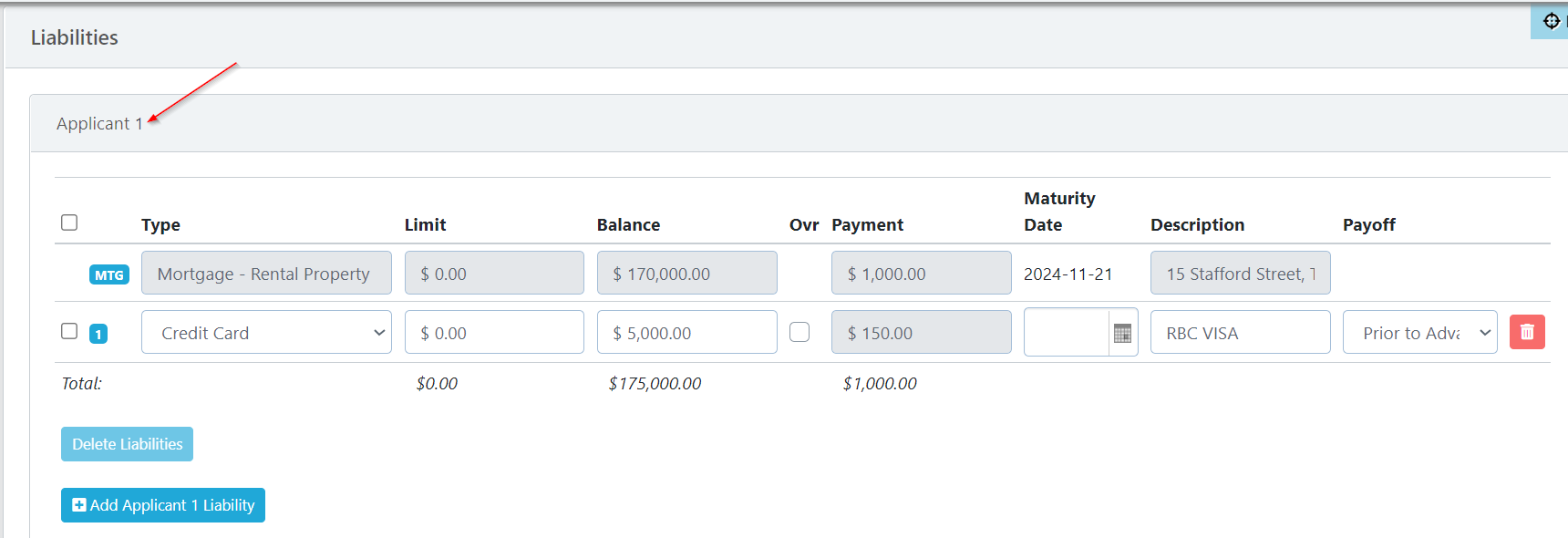

The liabilities section has a subsection for each applicant. Tradelines that were copied over from Applicant 1's credit report will show up in the Liabilities section for Applicant 1, Tradelines copied from Applicant 2's credit report will show up in the Liabilities section for Applicant 2, etc. You can verify which applicant's debts you are reviewing by paying attention to the subheader.

Copied Liabilities from the Credit Bureau

When you chose the "Copy Liabilities" function on a credit pull, any open tradelines with balances will pull into the liabilities section of the client.

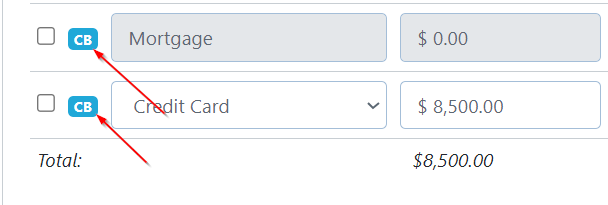

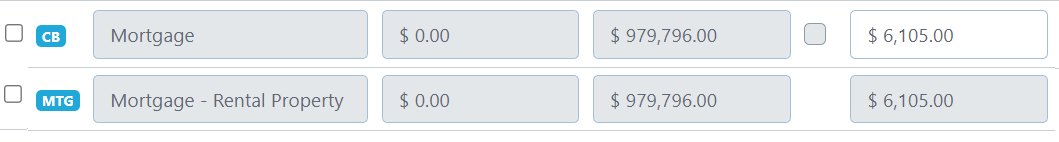

These liabilities have "CB" next to them

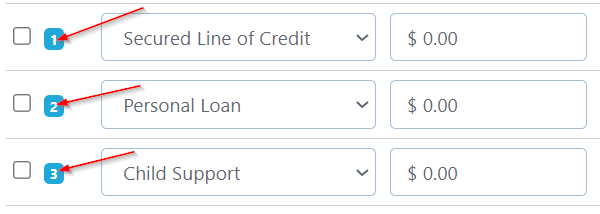

Manually Created Liabilities

Liabilities that you have entered manually show with a sequential number next to them.

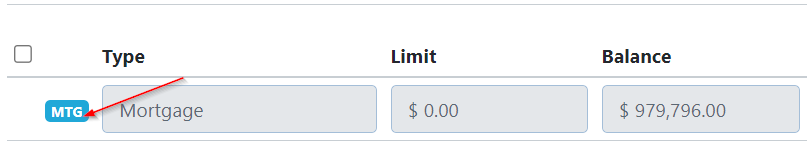

Mortgages from the Properties Owned Section

Any mortgage that you have entered into the properties owned section will also show in the liabilities section, as long as it is not indicated as being paid from proceeds or prior to advance. These are indicated in the liabilities section with "MTG" next to them.

These mortgages can only be edited from the Properties Owned section, not from the Liabilities section.

Joint Tradelines

If your applicants have joint tradelines, expect for the tradeline to be imported into each of their liabilities sections individually.

Proper process is to delete the tradeline from one of the liabilities screens so that it is factored in to ratios only once.

Duplicate Mortgages on the Liabilities Screen

Sometimes the mortgage may show twice on your liabilities screen, as below:

In this instance, the top line was brought into the liabilities section from the credit bureau (CB) and the second line is brought into the liabilities section from the Properties Owned (MTG).

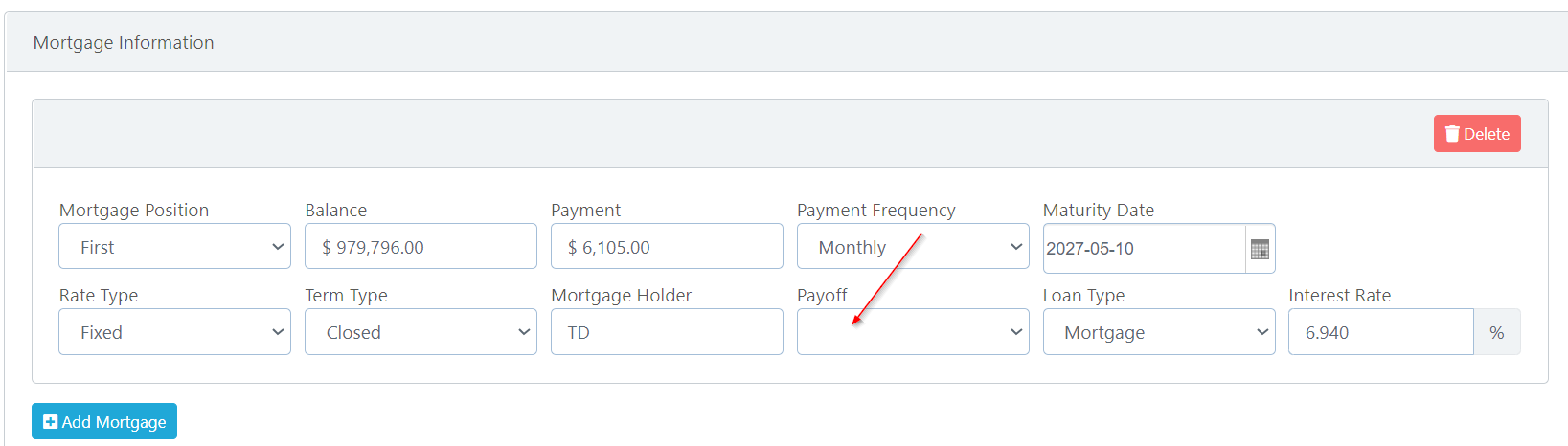

If we go down to the Properties Owned section, we can see the information on the mortgage here. Because it does not have anything in the Payoff field, it is being included in ratios and shows in the Liabilities section.

As best practice, we should delete the duplicate mortgage line that came in from the credit bureau, as that line does not contain the additional information contained in the line from the properties owned section.

Indicating Debts as to be Paid (Removing from Ratios)

The payoff field in the liabilities screen allows you to indicate whether the debt will be paid Prior to Advance or From Proceeds. Note that use of either of these options removes that tradeline from ratios.

Remember that to indicate a mortgage as being paid, you must do so from the Properties Owned section. It will be grayed out from the liabilities screen.

Revolving Debt Payment Override

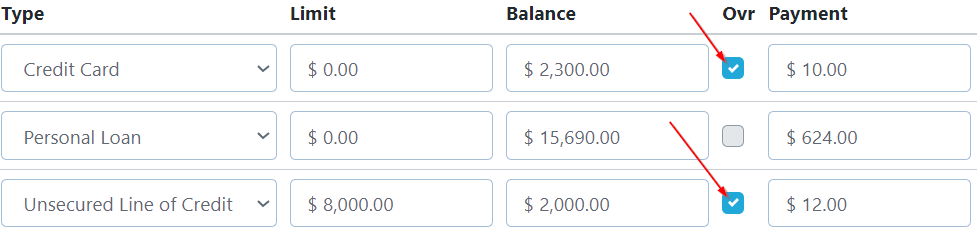

When you copy liabilities from the credit bureau, some debts, like credit cards and lines of credit, will have a minimum payment indicated on the credit bureau which is copied into the liabilities screen. This amount may be less than the percentage of the balance you are required to service for a mortgage.

Unchecking the "Ovr" box will cause the system to calculate the payment at 3%. Conversely, checking the "Ovr" box will allow you to enter a different payment amount into the Payment box.

Scarlett Tips

Why do mortgages copy from the credit bureau?

The mortgages copy in to provide you with the last reported balance and so that you can make sure all the mortgages are accounted for. If you already have them indicated on the associated property in Properties Owned, simply delete the credit bureau copy from the liabilities window.

Why did the tradeline copy as the wrong type of credit?

The system copies in the liabilities based on the information on the credit bureau. Sometimes the credit bureau doesn't code the tradeline correctly, or has the trade miscoded. Most often in this we see Lines of Credit without an indicator as to whether they are secured or unsecured, in which case the system brings them in as unsecured.

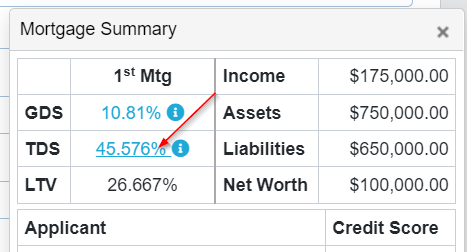

Preview Debts included in Ratios

You can click on the TDS in the summary window to get a breakdown of the debts being included in this ratio.