Offering Canada Life Mortgage Protection Insurance

Canada Life Mortgage Protection Insurance is integrated into Scarlett Mortgage so that you can generate an option for your clients within the deal. You can print an application, send it to them for e-signature, or use the digital link to offer the protection through the Services tab in your deal.

Related Training

Offering Mortgage Protection Plan (MPP)

Video Walkthrough

Coming Soon.

Step-by-Step Guide

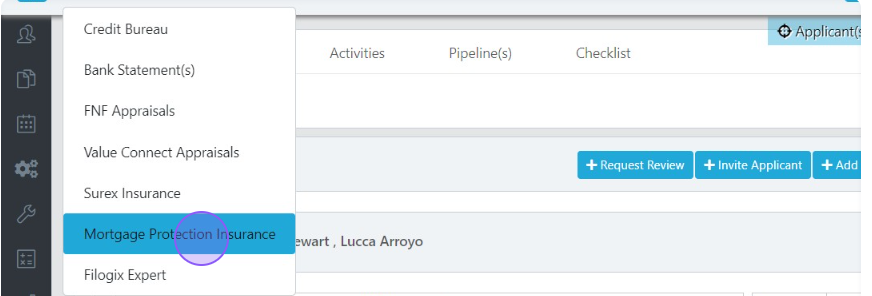

1) Under the Services tab of your deal, click 'Mortgage Protection Insurance'

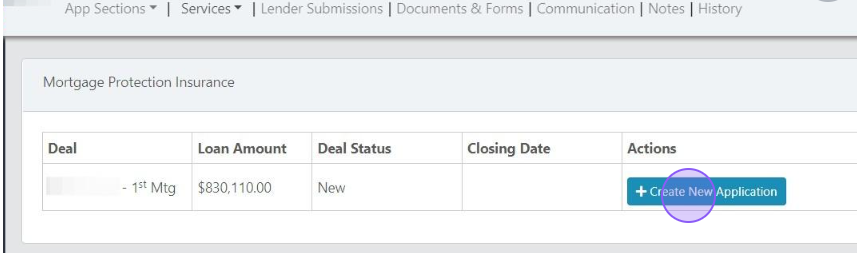

2) Click '+Create New Application'

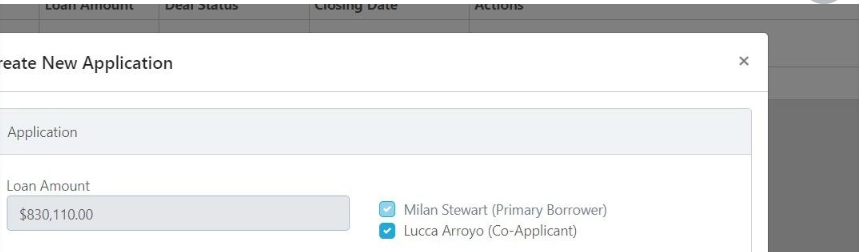

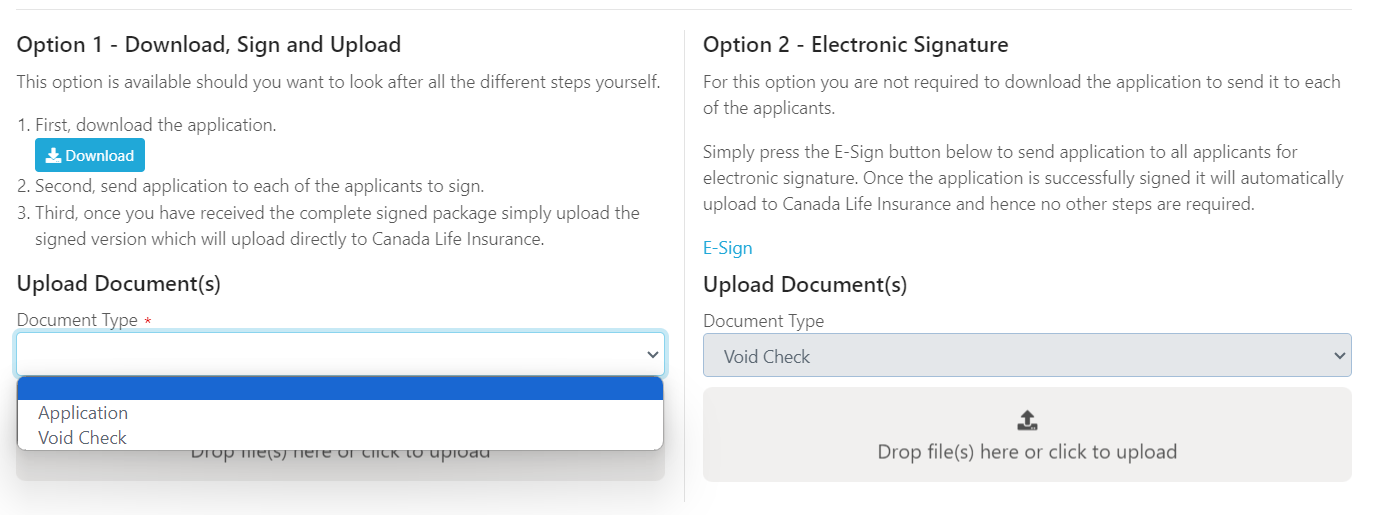

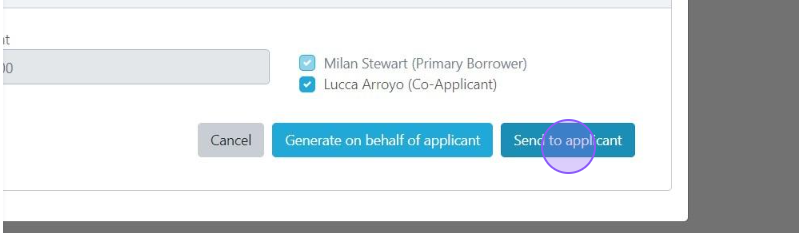

3) Select the applicant(s) you want to generate the application for.

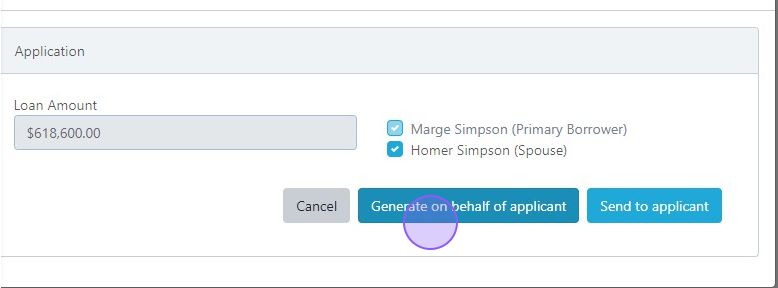

From here you have two options: Generate on behalf of applicant or Send to applicant.

Option 1: Generate on behalf of applicant

1) Click 'Generate on behalf of applicant'

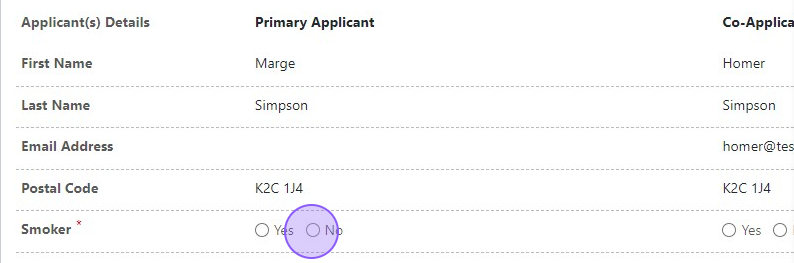

2) Select whether your clients are smokers or not.

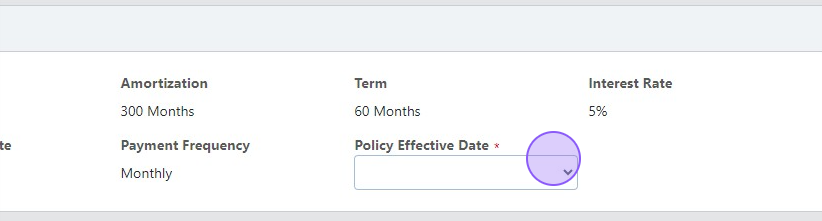

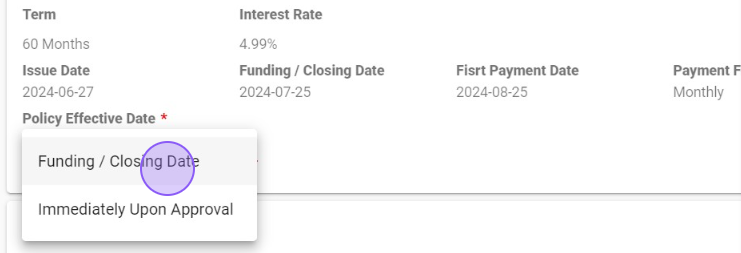

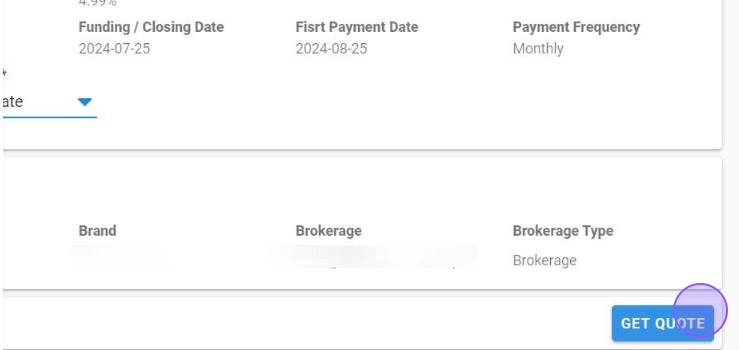

3) Select the policy effective date. The options are Funding/Closing Date or Immediately Upon Approval.

4) Click 'Get Quote'

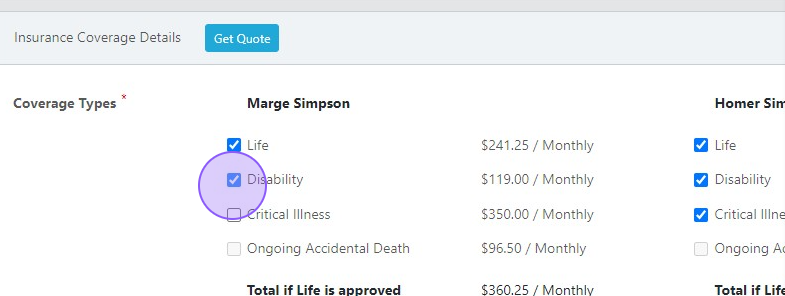

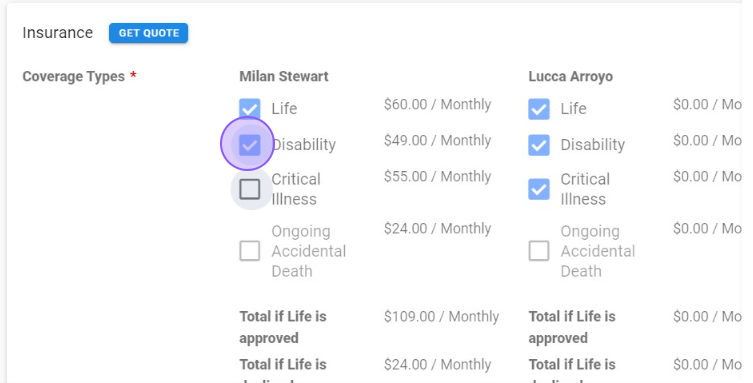

5) Select the coverage options for your client(s)

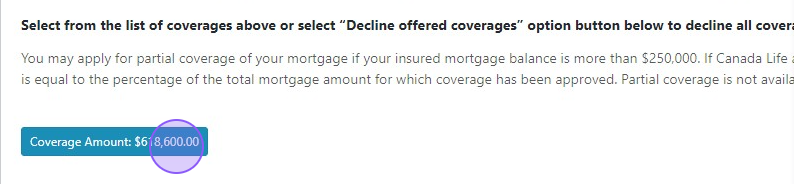

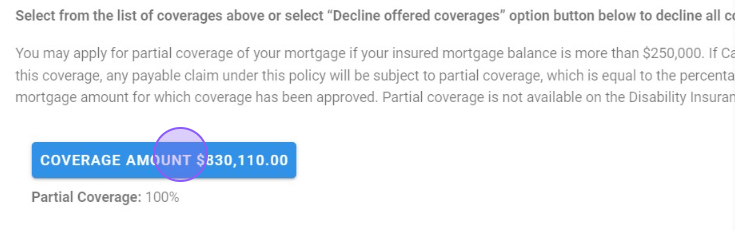

6) You have the option to adjust the coverage amount.

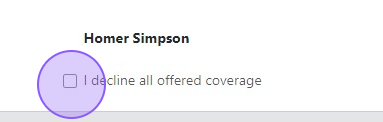

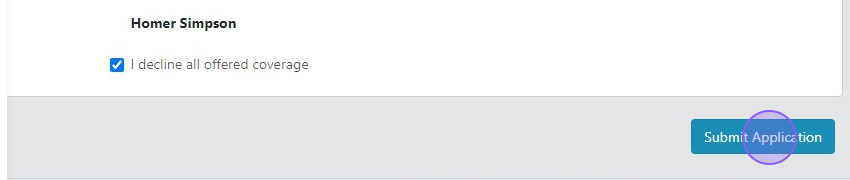

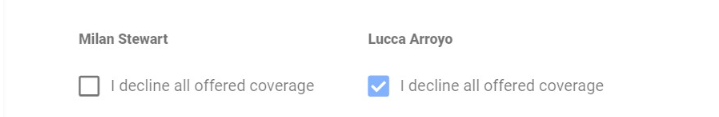

7) You have the option to opt the client(s) out of all coverage by clicking 'I decline all offered coverage'

8) Click 'Submit Application'

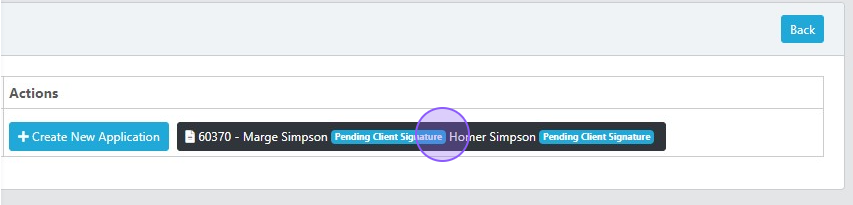

9) Your application will now show as pending client signature(s). Click here.

10) Have your clients sign the documents.

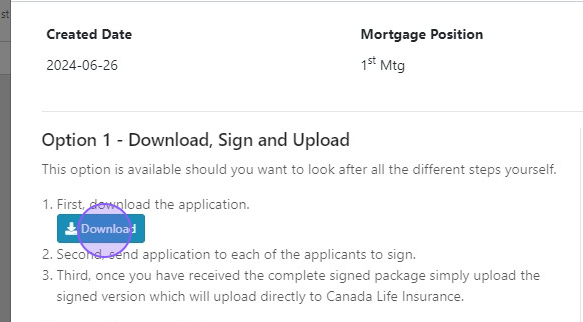

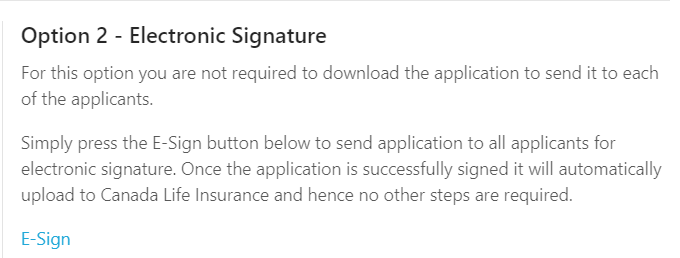

You can download the application to send to your client for signature.

Alternatively, you can send the documents for e-signature.

11) Upload documents. If you sent the application to your clients, you will need to upload the signed copy. For both options you will need to upload the void check, if the clients elected to apply coverage.

Option 2: Send to Applicant

1) Click 'Send to applicant'

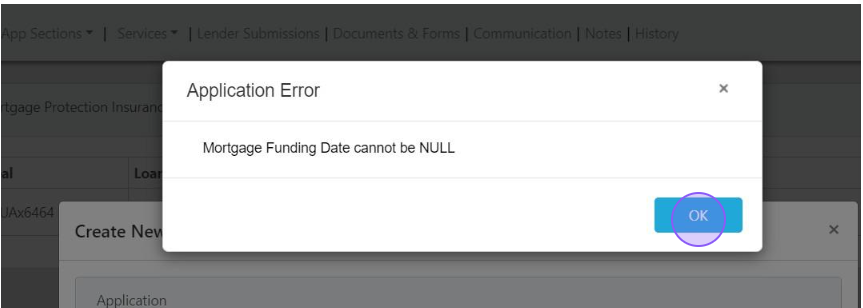

2) If the application is missing any information, you will receive a pop-up telling you what must be corrected. In this example, we are missing the Funding Date. Correct the missing information and begin again.

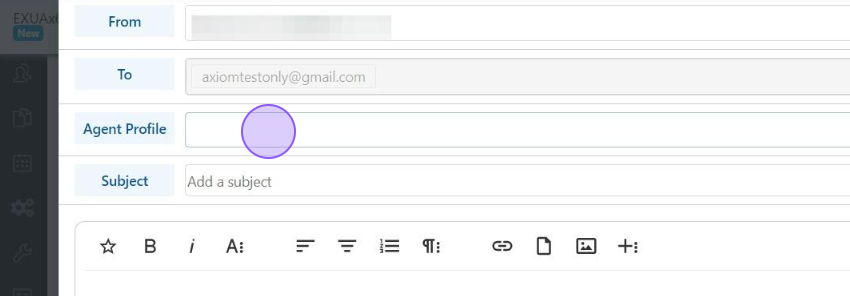

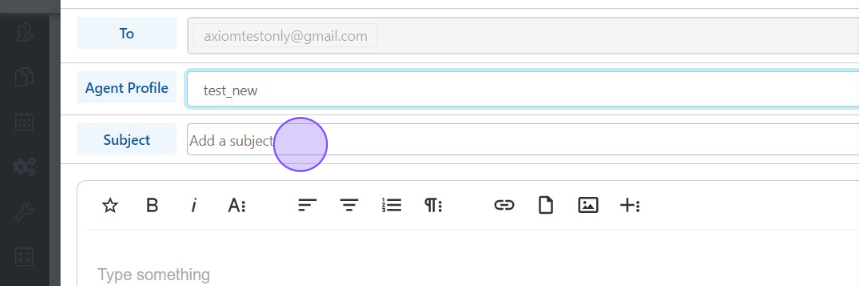

3) Select the Agent Profile.

4) Add a subject and enter email content.

5) Click 'Send'

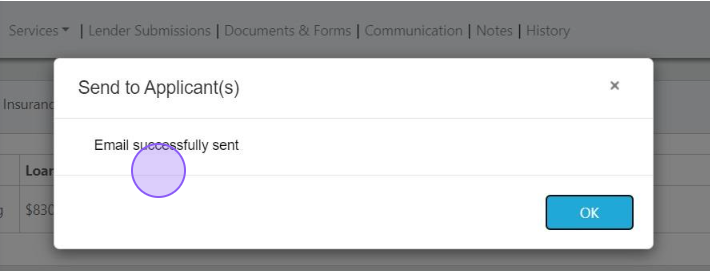

6) You will see the confirmation message that the email was sent.

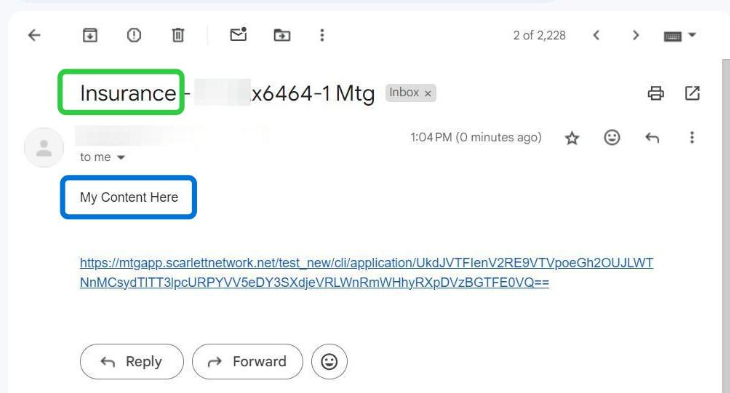

7) Your client will receive an email that looks like the below. The green box is the subject you entered, and the blue box is the email message body you entered. Note that the link is inserted below the message body.

8) Your client will also receive a second email with a verification code.

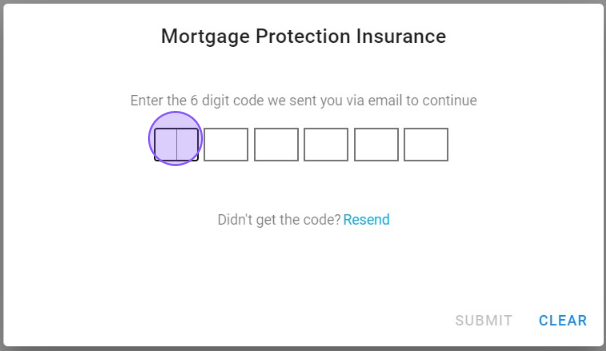

9) Your client will click the link and enter the code.

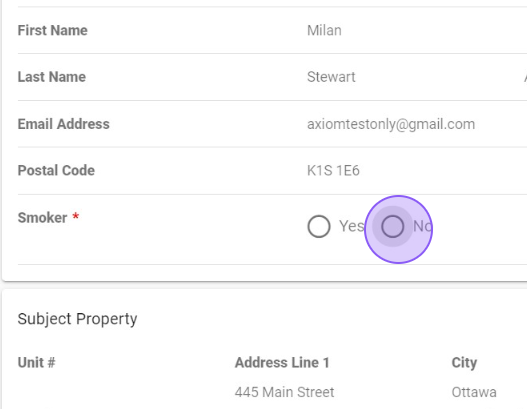

10) Your client will select their smoking status,

policy effective date,

and click 'Get Quote'.

11) Your client can then opt in or out to different insurance options and see how their monthly premium will be affected.

12) They have the option to change the amount of coverage by clicking 'Coverage Amount'

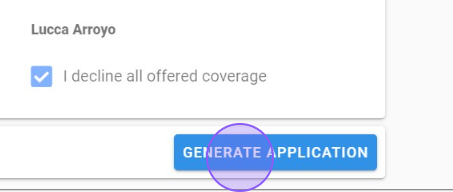

13) Your client can also waive the insurance by declining the offer.

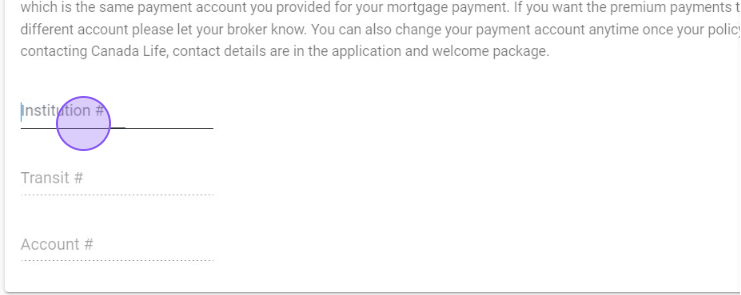

14) If your clients opted into coverage, they will be prompted for their PAD information.

15) Then your clients will click 'Generate Application'

Scarlett Tips

Your brokerage will offer either Canada Life or Manulife Mortgage Protection insurance, but not both.